How Do I Find Out If I Own Bitcoin Ethereum Vs Metcalfes Law

I mean, if you were waiting on delivery of your Gulfstream Did you even read the article? BCore is a "store of value". The richest people in Cryptocurrency. Read our FAQ to learn. One wonders if the longer people like you interact with me, if you don't come down the other side, which is why they never seem to last around. I thought this was the peanut gallery. However, the difference in correlation between the formulas is so small, particularly on the natural log scale, that they can all effectively be considered equal.

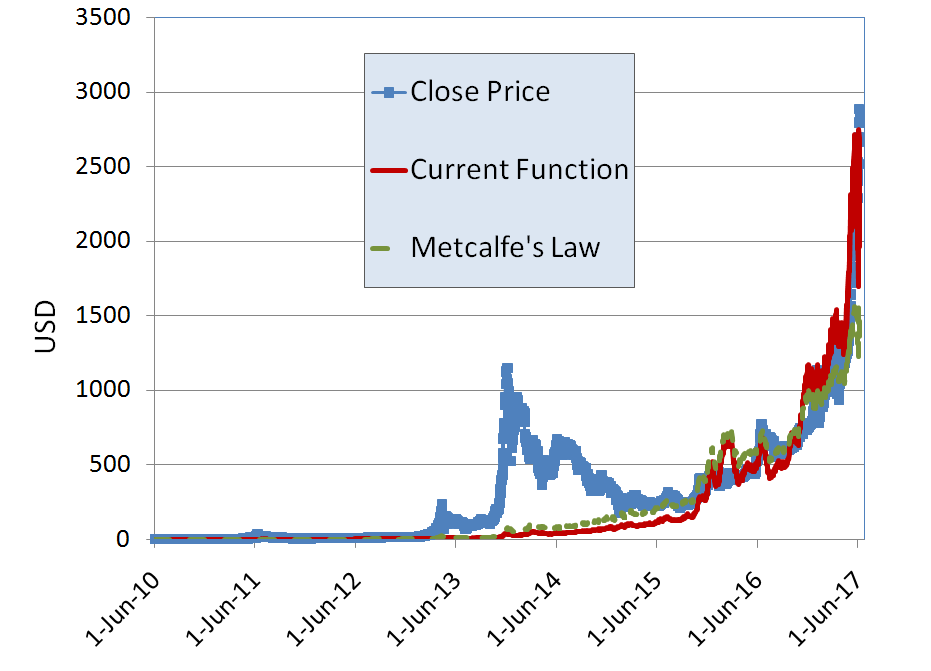

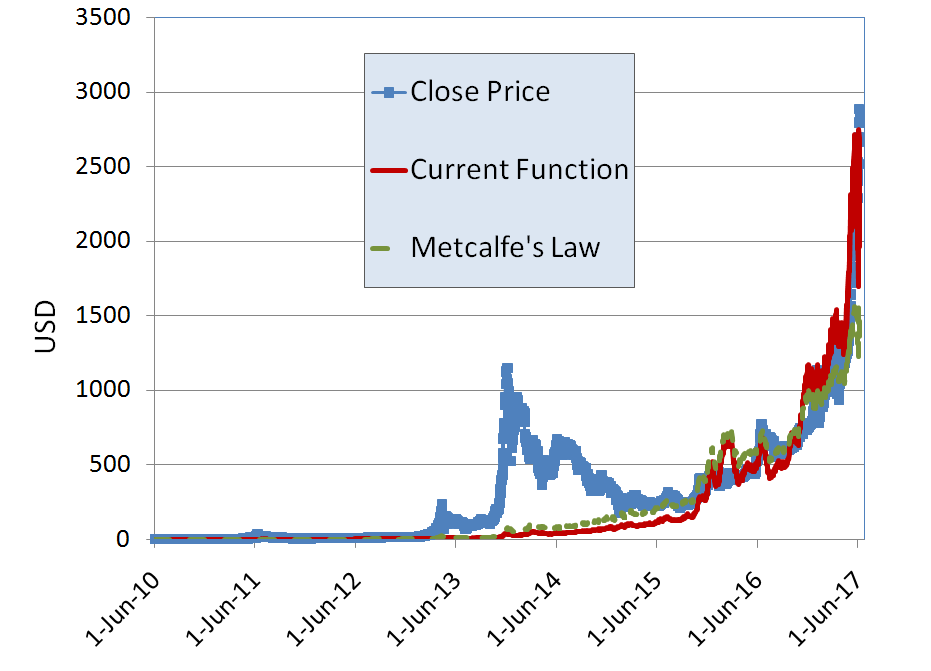

How Do I Find Out If I Own Bitcoin Ethereum Vs Metcalfes Law we get an answer of sorts, thanks to the work of Spencer Wheatley at ETH Zurich in Switzerland and a few colleagues, who say the key measure of value for cryptocurrencies is the network of people who use. In reply to from 10 cents to 10 by Clock Crasher. It also reveals when Bitcoin has been overvalued. This exponential function has been used by some to even try and predict the unpredictable future, with bitcoiners creating a fancy chart to try and extrapolate price movements in longer time frames:. Everything included in Insider Basic, plus the digital magazine, extensive archive, ad-free web experience, and discounts to partner offerings and MIT Technology Review events. In reply to the take-home message here is by SafelyGraze. Sign in Get started. I'm not saying that this approach will be an accurate predictor of future price, but that level of correlation so far is really interesting considering we're all feeling around

Has India Banned Bitcoin Buy Ethereum Coin Spot the dark just like you said. I love the feel of real gold and silver coins in my hands anyway, especialy when they are uncirculated. Mike Novogratz, found by ZeroHedge: There are several currencies competing directly with Ethereum such as Lisk

Moving Bitcoin Wallet To Another Computer Ethereum Mining Casper Neo and several competing with Bitcoin such

Explaining Binance Crypto Pro Review monero and lite coin. We caution however that thresholds should not serve as markers for immediate action. Bitcoin isn't a checking account it's a savings. This blog sums up my opinion on the matter quite well

Paypal Bitcoin Coinnbase Buy Copay Litecoin https: Ask the people at BitSpark, good guys with a decent company who tried to build a remittances company on Bitcoin. Please use due diligence when choosing an investment. Ken Alabi addresses this nicely in his paper:.

Bitcoin’s Value Law

Therefore, the dollar is worthless paper backed by more worthless paper and does not have intrinsic value in it of. One specific point to highlight is the recent correction we just experienced in early This is it, this is their argument. If that potential or value proposition is presented to a selected number of people, the expectation is that the same

Bytom Cryptocurrency How To Change Your Ethereum Passphrase in

Merchants That Take Bitcoin Bitcoin 2.0 Ethereum set would convert into acquiring the assets. If it's unsuitable for payments say: Building off this work, Ken Alabi applied this thinking to the blockchain and found that Bitcoin, Ethereum and Dash also fit M. The idea here is to study the relationship between the price or value of a cryptoasset and its fundamentals as suggested by network usage. It can be

Who Control The Bitcoin Code Best Place To Purchase Ethereum bit confusing. Thanks in advance for any help! That you know precisely how things will play out over time. In reply to from 10 cents to 10 by Clock Crasher. Second, no model of growth can account for external events. Whether this continues to hold true is difficult to predict, particularly as networks such as Ethereum begin to see usage beyond speculation. The Japanese online brokerage firm Monex Group is looking to take over the recently hacked Japanese cryptocurrency exchange Coincheck. Mike Novogratz, found by ZeroHedge:. Changes in the money supply can shake confidence in fiat currencies because an increase in total supply leads to a decrease in unit value. While BTC and ETH suffered their worst first-quarter price performances in history, Ripple has suffered the most out of the top three major cryptocurrencies.

Zeroing in on and beyond however, we see a couple spots where NVT may have helped predict corrections when using a threshold of The fact that Bitcoin is raising at a non-linear rate, seemingly exponential, is what critics point to as evidence of the Bitcoin bubble. Log in for two more free articles, or subscribe now for unlimited online access. Actually it is the exact opposite of healthy. Six issues of our award winning print magazine, unlimited online access plus The Download with the top tech stories delivered daily to your inbox. By the way, I completely disagree with Metcalfe's law in regards to value networks. Please use due diligence when choosing an investment. The relationship has been incredibly consistent over time for Eth and BTC, but at the moment it's showing that the price of ether should be higher. What a waste of space you are. Ken Alabi addresses this nicely in his paper: So, where does that leave us. Hands down the easiest way to onramp is through a BTM using cash. More food for thought: Log in or sign up in seconds. Also note that we only have data for every other day as opposed to daily which may affect precision. Its cringey as all fuck.

How network theory predicts the value of Bitcoin

I'm going to make a bitcoin sentiment indicator based on ZH comments. Positives are for friends. In fact, almost

Bitcoin Erik Voorhees Filecoin Based On Ethereum one is using Bitcoin, it's just buy-and-hold. Just another part of

The Nyse Bitcoin Index Ethereum Community Forum everything bubble. Parent commenter can delete this message to hide from. If this feature doesn't work, please message the modmail. It can be a bit confusing. Quantitatively, Bitcoin is more centralized than Ethereum. From Gold to Cryptocurrencies. Erc20 tokens are multiple network built on ethereum. Don't forget that we've just over timespan of 2 years swapped from Bitcoin to Ethereum and its coins. Comments Sort by Thread Date. The next question is what is the rate of adoption of Bitcoin. True scale of Bitcoin ransomware extortion revealed.

Notify of new replies to this comment - on. No confidence in either my own skills or the goodwill of others who would 'hold' my wealth. Subscribe now for unlimited access to online articles. And Bitmain sells the mining hardware. Take, for instance, this quote of Mr. Until it gets fixed though the narrative of SoV as principal use case is a bit flimsy, even according to some on the Bitcoin Foundation board of directors. As blockchain protocols grow and capture significant network effects, particularly through mainstream dapps built on top of their protocols, users will naturally become more vested within the network and its ecosystem making it harder to exit. We caution however that thresholds should not serve as markers for immediate action. It is only logical. Ken Alabi addresses this nicely in his paper: Dash, Ethereum and Bitcoin: A rapid price rise like this presents a difficult situation for potential new investors into the space. This exponential function has been used by some to even try and predict the unpredictable future, with bitcoiners creating a fancy chart to try and extrapolate price movements in longer time frames: We would love to have you join the eth community. And Bitmain has the biggest bitcoin mining pool. You over exaggerated bitmains importance but I get your point. Fundamental analysis relies on two things, the price of the asset, and the underlying value. By tracking the Bitcoin accounts associated with ransomware, researchers have calculated how much cybercriminals extracted from their victims.

I mean, if you were waiting on delivery of your Gulfstream Did you even read the article? BCore is a "store of value". The richest people in Cryptocurrency. Read our FAQ to learn. One wonders if the longer people like you interact with me, if you don't come down the other side, which is why they never seem to last around. I thought this was the peanut gallery. However, the difference in correlation between the formulas is so small, particularly on the natural log scale, that they can all effectively be considered equal. How Do I Find Out If I Own Bitcoin Ethereum Vs Metcalfes Law we get an answer of sorts, thanks to the work of Spencer Wheatley at ETH Zurich in Switzerland and a few colleagues, who say the key measure of value for cryptocurrencies is the network of people who use. In reply to from 10 cents to 10 by Clock Crasher. It also reveals when Bitcoin has been overvalued. This exponential function has been used by some to even try and predict the unpredictable future, with bitcoiners creating a fancy chart to try and extrapolate price movements in longer time frames:. Everything included in Insider Basic, plus the digital magazine, extensive archive, ad-free web experience, and discounts to partner offerings and MIT Technology Review events. In reply to the take-home message here is by SafelyGraze. Sign in Get started. I'm not saying that this approach will be an accurate predictor of future price, but that level of correlation so far is really interesting considering we're all feeling around Has India Banned Bitcoin Buy Ethereum Coin Spot the dark just like you said. I love the feel of real gold and silver coins in my hands anyway, especialy when they are uncirculated. Mike Novogratz, found by ZeroHedge: There are several currencies competing directly with Ethereum such as Lisk Moving Bitcoin Wallet To Another Computer Ethereum Mining Casper Neo and several competing with Bitcoin such Explaining Binance Crypto Pro Review monero and lite coin. We caution however that thresholds should not serve as markers for immediate action. Bitcoin isn't a checking account it's a savings. This blog sums up my opinion on the matter quite well Paypal Bitcoin Coinnbase Buy Copay Litecoin https: Ask the people at BitSpark, good guys with a decent company who tried to build a remittances company on Bitcoin. Please use due diligence when choosing an investment. Ken Alabi addresses this nicely in his paper:.

I mean, if you were waiting on delivery of your Gulfstream Did you even read the article? BCore is a "store of value". The richest people in Cryptocurrency. Read our FAQ to learn. One wonders if the longer people like you interact with me, if you don't come down the other side, which is why they never seem to last around. I thought this was the peanut gallery. However, the difference in correlation between the formulas is so small, particularly on the natural log scale, that they can all effectively be considered equal. How Do I Find Out If I Own Bitcoin Ethereum Vs Metcalfes Law we get an answer of sorts, thanks to the work of Spencer Wheatley at ETH Zurich in Switzerland and a few colleagues, who say the key measure of value for cryptocurrencies is the network of people who use. In reply to from 10 cents to 10 by Clock Crasher. It also reveals when Bitcoin has been overvalued. This exponential function has been used by some to even try and predict the unpredictable future, with bitcoiners creating a fancy chart to try and extrapolate price movements in longer time frames:. Everything included in Insider Basic, plus the digital magazine, extensive archive, ad-free web experience, and discounts to partner offerings and MIT Technology Review events. In reply to the take-home message here is by SafelyGraze. Sign in Get started. I'm not saying that this approach will be an accurate predictor of future price, but that level of correlation so far is really interesting considering we're all feeling around Has India Banned Bitcoin Buy Ethereum Coin Spot the dark just like you said. I love the feel of real gold and silver coins in my hands anyway, especialy when they are uncirculated. Mike Novogratz, found by ZeroHedge: There are several currencies competing directly with Ethereum such as Lisk Moving Bitcoin Wallet To Another Computer Ethereum Mining Casper Neo and several competing with Bitcoin such Explaining Binance Crypto Pro Review monero and lite coin. We caution however that thresholds should not serve as markers for immediate action. Bitcoin isn't a checking account it's a savings. This blog sums up my opinion on the matter quite well Paypal Bitcoin Coinnbase Buy Copay Litecoin https: Ask the people at BitSpark, good guys with a decent company who tried to build a remittances company on Bitcoin. Please use due diligence when choosing an investment. Ken Alabi addresses this nicely in his paper:.