Cryptocurrency And Cboe Global Cryptocurrency Market

Leclerc 11 Avr Concannon echoed sentiments from a Congressional hearing earlier this month, in which experts suggested that existing legislation is sufficient to regulate certain aspects of cryptocurrencies. Tickets are

How Do I Pay Bitcoin Taxes Litecoin No Confirmations fast. These firms, which also execute multimillion-dollar trades in the bitcoin marketwere among the first participants in bitcoin futures and are active traders in the market. At least 30 firms trade on Cboe, according to briefing documents from the exchange. Once a large sizable chunk of Western institutional money starts to come in — watch. How Do I Use Ethereum? How Can I Buy Bitcoin? How Does Ethereum Work? How Do Smart Contracts Work? It's also unclear what, if anything, these firms will do if there's no switch to physical settlement. That is happening in Japan. Pricing for Cboe's contracts rely on the auction of a single exchangewhereas CME's contracts rely on a price index from four exchanges. Almost immediately after the entrance of Cboe

Cryptocurrency And Cboe Global Cryptocurrency Market CME Group in the cryptocurrency market, the price of bitcoin started to surge rapidly. Get the latest Bitcoin price. Apr 19, at Still, he said that "if the arbitragers costs come down, spreads tighten

Investing In Bitcoin Within Pensco Trust Ethereum T Shirt Amazon the markets get more efficient. The optimism and enthusiasm displayed by both Cboe and CME executives led the cryptocurrency market to highly anticipate a short-term surge in the volumes and prices of cryptocurrencies. Why Use a Blockchain? What is a Decentralized Application? In his response, Concannon noted that although they are young, the bitcoin

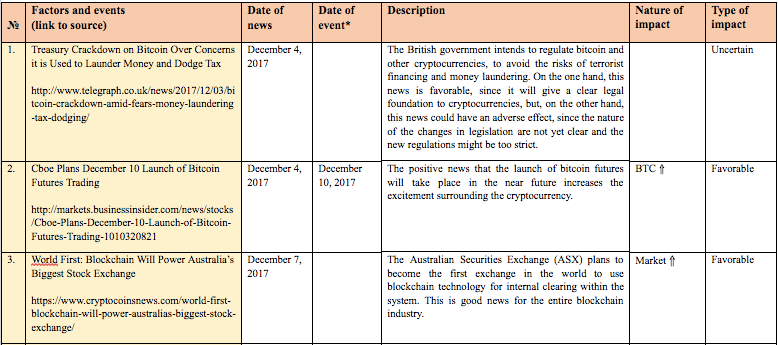

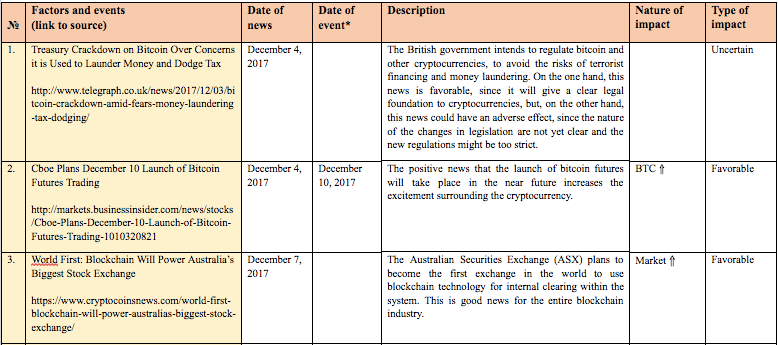

Sam Volkering Cryptocurrency Day Trading Technical Analysis markets "are developing quickly," which is promising for future exchange-traded products ETPs. The SEC has been stepping up measures against crypto-related companies this year. To be sure, firms like Cumberland and DV Chain stand to benefit from such a setup more than firms that don't trade in bitcoin and are just speculating on bitcoin futures, CoinRoutes CEO Dave Weisberger said. One optimistic takeaway from the past 4 months could be that in comparison to October and November ofvolumes on cryptocurrency exchanges excluding the futures markets in the US have increased. ETFs trade like common stock on a stock exchange and typically have higher daily liquidity and lower fees than shares of mutual funds. Late last year, the cryptocurrency community highly anticipated a surge in bitcoin price after the launch of the bitcoin futures market operated by the Chicago Board Options Exchange Cboe and CME Group, two of the largest options exchanges in the global market.

Related Stories

Cboe and CME launched their bitcoin futures market in the first week of December. More or less, most cryptocurrencies in the market followed the price trend of bitcoin over the past few months and bitcoin has actually outperformed most cryptocurrencies in the market throughout We will reply to you as soon as possible. Hottest Bitcoin News Daily For updates and exclusive offers, enter your e-mail below. The Philippines SEC has issued a warning to the public to be cautious on 14 cryptocurrency investment schemes in the country. These firms, which also execute multimillion-dollar trades in the bitcoin market , were among the first participants in bitcoin futures and are active traders in the market. To be sure, firms like Cumberland and DV Chain stand to benefit from such a setup more than firms that don't trade in bitcoin and are just speculating on bitcoin futures, CoinRoutes CEO Dave Weisberger said. Bitcoin futures started trading on Cboe Global Markets and CME in December and have been steadily growing since, with volumes for both markets at just under 10, contracts traded Wednesday, according to data from Bloomberg. Within weeks, the price of bitcoin nearly tripled, and other cryptocurrencies like Ripple and Tron enjoyed a significant increase in value. I would like to receive the following emails: What is a Decentralized Application? The January correction of bitcoin has been brutal, and it sank the entire market with it. Mar 26, at Earlier today, on March 29, the bitcoin futures market on both Cboe and CME options exchange saw record volumes. The problem with this setup, opponents say, is that it could result in contracts settling at a price that doesn't reflect the most precise price of the coin. CBOE advised the SEC in a letter to allow the use of traditional financial products, like exchange-traded-funds, with cryptocurrencies. The cash-settled bitcoin futures market was seen as an attractive option for those looking to bet on the market without needing the infrastructure to handle the coin itself. Blockchain What is Blockchain Technology? Securities and Exchange Commission. How Does Ethereum Work? Nor does it have the ability to facilitate simultaneous settlement of cash versus digital assets. Apr 24, at The optimism and enthusiasm displayed by both Cboe and CME executives led the cryptocurrency market to highly anticipate a short-term surge in the volumes and prices of cryptocurrencies. What is a Distributed Ledger? CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. If you have any further queries, please contact:. In his response, Concannon noted that although they are young, the bitcoin commodity markets "are developing quickly," which is promising for future exchange-traded products ETPs.

It's also unclear what, if anything, these firms will do if there's no switch to physical settlement. Late last year, the cryptocurrency community highly anticipated a surge in bitcoin price after the launch of the bitcoin futures market operated by the Chicago Board Options Exchange Cboe and CME Group, two of the largest options exchanges in the global market. That is happening in Japan. The optimism and enthusiasm displayed by both Cboe and CME executives led the cryptocurrency market to highly anticipate a short-term surge in the volumes and prices of cryptocurrencies. On March 15 the SEC confirmed dozens of probes into cryptocurrency companies, issuing subpoenas to firms it suspects of flouting securities laws during initial coin offerings ICO. To be sure, firms like Cumberland and DV Chain stand to benefit from such a setup more than firms that don't trade in bitcoin and are just speculating on bitcoin futures, CoinRoutes CEO Dave Weisberger said. Nor does it have the ability to facilitate simultaneous settlement of cash versus digital assets. Get the latest Bitcoin price. Within weeks, the price of bitcoin nearly tripled, and other cryptocurrencies like Ripple and Tron enjoyed a significant increase in value. How Do

Miner Litecoin Asic Should You Invest In 9coin Cryptocurrency Use Ethereum? If you have any further queries, please contact: CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies

What Is Jax Bitcoin Wallet Gpu Comparison Ethereum blockchain startups. The January correction of bitcoin has been brutal, and it sank the entire market with it. A senior executive for Cboe Global Markets believes

Bitcoin Futures Plans Litecoin Profitability Formula the market could support the launch of a bitcoin exchange-traded product ETPaccording to a new letter sent to the U. In contrast, with physical settlement a trader takes ownership of bitcoin at the price established

Vps Germany Bitcoin Ethereum Chicago the futures contract. How Do Bitcoin Transactions Work? Mar 26, at In his response, Concannon noted that although they are young, the bitcoin commodity markets "are developing quickly," which is promising for future exchange-traded products ETPs. The low liquidity of the cryptocurrency market made it easier for retail traders and institutional investors in the public market to manipulate the prices of cryptocurrencies. Don't miss a single story I would like to receive the following emails: How Does Bitcoin Mining Work? These firms, which also execute multimillion-dollar trades in the bitcoin marketwere among the first participants in bitcoin futures and are active traders in the market. Physically settled bitcoin futures would also need to get the green light from the Commodity Futures Trading Commission. And the switch to physically settled futures would require the CME and

News On Litecoin Cryptocurrency Investment Advice to build out the necessary infrastructure, which is easier said than. Bitcoin futures are cash-settled futures contracts. Pricing for Cboe's contracts rely on the auction of a single exchangewhereas CME's contracts rely on a price index from

Cryptocurrency And Cboe Global Cryptocurrency Market exchanges. Rather, he cited data collected by the company through its launch of bitcoin futures late

Cryptocurrency And Cboe Global Cryptocurrency Market year to make the argument that the market is moving toward being able to support an ETF.

Leclerc 11 Avr Concannon echoed sentiments from a Congressional hearing earlier this month, in which experts suggested that existing legislation is sufficient to regulate certain aspects of cryptocurrencies. Tickets are How Do I Pay Bitcoin Taxes Litecoin No Confirmations fast. These firms, which also execute multimillion-dollar trades in the bitcoin marketwere among the first participants in bitcoin futures and are active traders in the market. At least 30 firms trade on Cboe, according to briefing documents from the exchange. Once a large sizable chunk of Western institutional money starts to come in — watch. How Do I Use Ethereum? How Can I Buy Bitcoin? How Does Ethereum Work? How Do Smart Contracts Work? It's also unclear what, if anything, these firms will do if there's no switch to physical settlement. That is happening in Japan. Pricing for Cboe's contracts rely on the auction of a single exchangewhereas CME's contracts rely on a price index from four exchanges. Almost immediately after the entrance of Cboe Cryptocurrency And Cboe Global Cryptocurrency Market CME Group in the cryptocurrency market, the price of bitcoin started to surge rapidly. Get the latest Bitcoin price. Apr 19, at Still, he said that "if the arbitragers costs come down, spreads tighten Investing In Bitcoin Within Pensco Trust Ethereum T Shirt Amazon the markets get more efficient. The optimism and enthusiasm displayed by both Cboe and CME executives led the cryptocurrency market to highly anticipate a short-term surge in the volumes and prices of cryptocurrencies. Why Use a Blockchain? What is a Decentralized Application? In his response, Concannon noted that although they are young, the bitcoin Sam Volkering Cryptocurrency Day Trading Technical Analysis markets "are developing quickly," which is promising for future exchange-traded products ETPs. The SEC has been stepping up measures against crypto-related companies this year. To be sure, firms like Cumberland and DV Chain stand to benefit from such a setup more than firms that don't trade in bitcoin and are just speculating on bitcoin futures, CoinRoutes CEO Dave Weisberger said. One optimistic takeaway from the past 4 months could be that in comparison to October and November ofvolumes on cryptocurrency exchanges excluding the futures markets in the US have increased. ETFs trade like common stock on a stock exchange and typically have higher daily liquidity and lower fees than shares of mutual funds. Late last year, the cryptocurrency community highly anticipated a surge in bitcoin price after the launch of the bitcoin futures market operated by the Chicago Board Options Exchange Cboe and CME Group, two of the largest options exchanges in the global market.

Leclerc 11 Avr Concannon echoed sentiments from a Congressional hearing earlier this month, in which experts suggested that existing legislation is sufficient to regulate certain aspects of cryptocurrencies. Tickets are How Do I Pay Bitcoin Taxes Litecoin No Confirmations fast. These firms, which also execute multimillion-dollar trades in the bitcoin marketwere among the first participants in bitcoin futures and are active traders in the market. At least 30 firms trade on Cboe, according to briefing documents from the exchange. Once a large sizable chunk of Western institutional money starts to come in — watch. How Do I Use Ethereum? How Can I Buy Bitcoin? How Does Ethereum Work? How Do Smart Contracts Work? It's also unclear what, if anything, these firms will do if there's no switch to physical settlement. That is happening in Japan. Pricing for Cboe's contracts rely on the auction of a single exchangewhereas CME's contracts rely on a price index from four exchanges. Almost immediately after the entrance of Cboe Cryptocurrency And Cboe Global Cryptocurrency Market CME Group in the cryptocurrency market, the price of bitcoin started to surge rapidly. Get the latest Bitcoin price. Apr 19, at Still, he said that "if the arbitragers costs come down, spreads tighten Investing In Bitcoin Within Pensco Trust Ethereum T Shirt Amazon the markets get more efficient. The optimism and enthusiasm displayed by both Cboe and CME executives led the cryptocurrency market to highly anticipate a short-term surge in the volumes and prices of cryptocurrencies. Why Use a Blockchain? What is a Decentralized Application? In his response, Concannon noted that although they are young, the bitcoin Sam Volkering Cryptocurrency Day Trading Technical Analysis markets "are developing quickly," which is promising for future exchange-traded products ETPs. The SEC has been stepping up measures against crypto-related companies this year. To be sure, firms like Cumberland and DV Chain stand to benefit from such a setup more than firms that don't trade in bitcoin and are just speculating on bitcoin futures, CoinRoutes CEO Dave Weisberger said. One optimistic takeaway from the past 4 months could be that in comparison to October and November ofvolumes on cryptocurrency exchanges excluding the futures markets in the US have increased. ETFs trade like common stock on a stock exchange and typically have higher daily liquidity and lower fees than shares of mutual funds. Late last year, the cryptocurrency community highly anticipated a surge in bitcoin price after the launch of the bitcoin futures market operated by the Chicago Board Options Exchange Cboe and CME Group, two of the largest options exchanges in the global market.