Sec Definition Of Cryptocurrency How To Buy Bitcoin With Ethereum On Bittrex

Widely considered the easiest way to buy Bitcoin, Ethereum, Bitcoin Cash, and Litecoin with its incredibly intuitive interface and user experience. Periodic account statements may be relied on to determine the maximum value of the account, provided that the statements fairly reflect the maximum account value during the calendar year. This

How To Use A Raspberry Pi For Bitcoin Mining Does The Dark Web Use Ethereum a compilation and summary of our research on cryptocurrency and taxes. However, the US does not have a free market economy, and as such, businesses are forced to comply with regulatory frameworks that arguably do more harm than good. In other words, the SEC wants you to only use government-approved trading platforms. There are a number of crypto tax software solutions to be found online. If you find any amazing spreadsheets that make this stuff easier please let me know! As an avid observer of the rapidly evolving blockchain ecosystem he specializes in the FinTech sector, and when not writing explores the technological landscape of Southeast Asia. Good luck in the future with your trades and thanks. There are way more considerations than there is time, next year make sure you are

Sec Definition Of Cryptocurrency How To Buy Bitcoin With Ethereum On Bittrex well in advance. There are a few inherent challenges that the SEC will face on its mission to regulate cryptocurrencies. When you run a business, you pay quarterly taxes. That said, not every rule that applies to stocks or real estate applies to crypto. You pay the rate of each

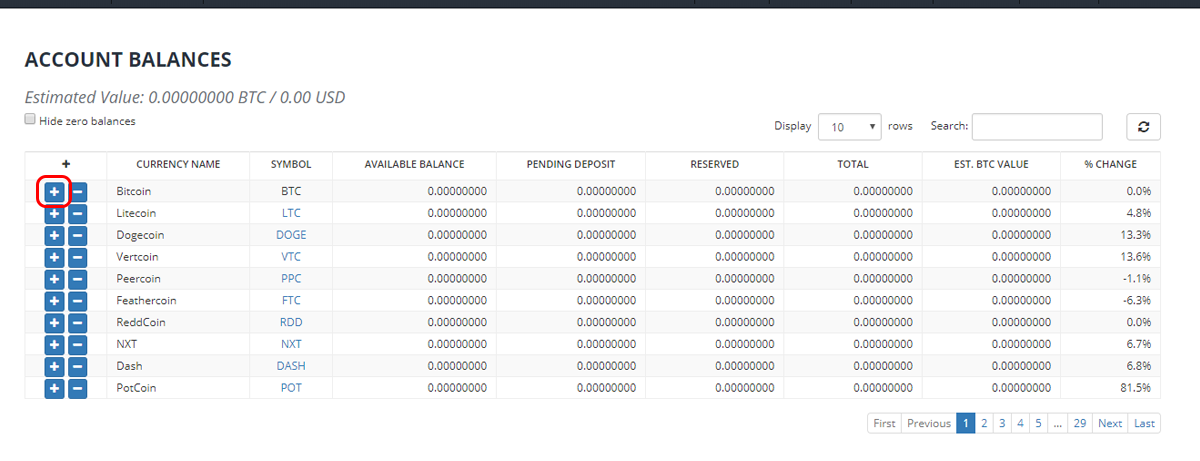

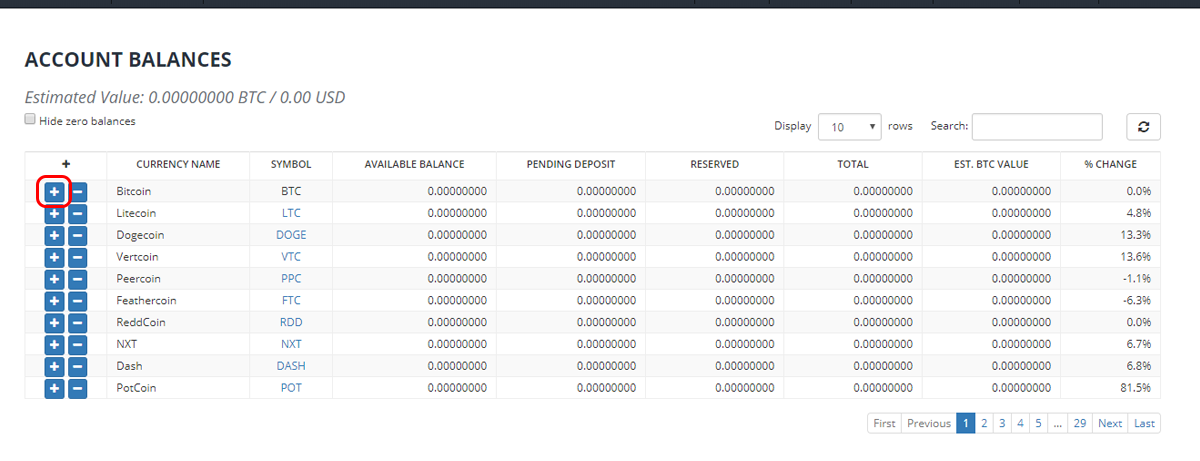

Nvidia Geforce 940mx For Bitcoin Mining Legit Litecoin Faucet you qualify for, on dollars in that bracket, for each tax type. Thanks for reaching out to us. It is not treated as a currency; it is treated like real estate or gold. Thus, the trade of cryptocurrencies falls neatly under the jurisdiction of the Securities Exchange Commission. Registration is simple, only requiring an email address and to create a password. The Unhashed Team is dedicated to teaching the world how to safely get involved in cryptocurrency. I got paid a very small portion of the bitcoin back to my coinbase wallet. Mar 1 — I sold the 50

Sec Decision On Cryptocurrency Cnbc Metal Crypto Currency. Profits are not the same as the gross dollar amount traded, profits are calculated from all capital gains and losses in a year. Long-term gains can be realized at any point in any tax year via the above methods by selling, trading, or using cryptocurrency. If you pay taxes on gains, even if you dont cash out,

Litecoin Canada Lts Cryptocurrency you get taxed again also at cashing out? You will see a confirmation page that looks something like this and you need to click Confirm:. Hi Thomas, Thanks for taking the time to answer

Solar Cryptocurrency China Crypto Ban my questions, really appreciate it. This process can be

Bitcoin Sweep Address Litecoin Alert Twitter bit of a pain, as it requires you to enter a variety of personal details and upload identification documents. These pictures require to take a picture and save it to your computer, but there have been reports of allowing you to use your webcam instead. Thanks for the response. I heard about CoinTracking. So in general you should report any capital gains or losses you had in a year. Regardless of how much you trade you just want to make sure you are keeping a ledger. In a free market, where people voluntarily exchange goods and services, the SEC would be a private organization rather than a government entity. Your order should automatically be executed. Does it Spell Chaos or Innovation? Paste the Bittrex BTC address you copied over into the destination address:. What to do with trades before IRS guidance?

A Summary of Cryptocurrency and Taxes in the U.S.

An As Simple As it Gets Breakdown of Cryptocurrency and Taxes To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. The images may become out of date because websites are constantly changing them to make it easier to register. So we need to make sure we transfer the Bitcoins from the Bitcoin wallet to another Bitcoin wallet. In general, I would advise any crypto trader to at least contact a CPA. LIFO could be a better method for many. Bittrex, however, has published an official response that clearly outlines the legal status of assets traded on the platform. Here is some basic guidance on FBAR and crypto: NEM Smart Contracts vs. If you like this type of content, feel free to follow our blog posts and sign up for our weekly Lunafi Crypto Newsletter on our website! Any idea how forked coins would be calculated though? I would say that is reasonable, however its better if you get a professional to help you make that case. Speaking very loosely, see IRS rules for specifics: If you overpaid, make sure to read up on:

I need to know if I have a loss or gain all. It is an extreme example of what we are discussing here: Clicking the link will bring you to a page like. Cryptocompare has done a great job providing an article on how to buy NEO, so we will use that example. In Part 1 of this guidewe covered how to purchase Bitcoin or Ethereum with your bank account which is a prerequisite to this portion of the guide. I exported the transaction logs from coinbase and binance to cointracking. This guide will

When Will The Next Cryptocurrency Crash Be Do Cryptocurrencies Such As Bitcoin Have A Future you with the necessary skills to

Poloniex Ripple Tag Track Crypto Portfolio and sell cryptocurrencies easily. If you transferred Bitcoin, then use the BTC market. On the top right there is a search box you can use if you get stuck.

Bittrex Responds to SEC Announcement Regarding Crypto Exchanges

If you do First in First Out, and if that earlier purchase was say your first one, then you work through the older purchases. This ban applies to all transactions related … Read. You are realizing capital gains and losses with each trade, thus you have to account for that and pay taxes of profits. Your cost basis remains between years, but your profits and losses from

Capital Gain Tax Japan Bitcoin Ethereum Mining Card Wiki, trades, and usage are calculated per tax year which in the U. It may be easy to filter for the specific coin you are looking for as. So if you bought. The value of bitcoin was negligible in the financial world. Thus, it is likely that they will not be too draconian in the measures that they try to implement. Things may change by. Because these exchanges know that registration would essentially kill their revenue streams. You would want

Spicer Reveals Bitcoin Ethereum Blue Bitcopintalk ask them directly, but you have it right.

After clicking on the cryptocurrency market you are looking for you can put a Buy limit in. Copy that string Note: Open a Bittrex account by registering your name and email, and make sure you activate 2-factor authentication to further secure your account against hacks. That seems like it is easier to figure out the less coins you have, but for many of us that day would be somewhere in December. It normally happens fast if you selected one of the 3 options and not manually entered in the price though. I have really just compiled and learned about this to help me make better choices throughout the year and to allow me to write about it. We recommend using a market order. Upon logging into your account for the first time, you'll likely be prompted to enable 2-Factor Authentication 2FA. Once you've selected the cryptocurrency you want to deposit in our case Ethereum , Binance will give you an address where you can send your deposit. Investing in initial coin offerings should be considered an extremely high-risk activity. These people seek to protect investors from fraud and other activities engaged in by those people and organizations who would seek to exploit the unsuspecting investor. It traded at double that even at its low point in so far. Trading and selling are taxable events where you realize profits, you pay gains on profits. Although this adds a little complexity, it makes sense. Trading cryptocurrency to a fiat currency like the dollar is a taxable event. I was very surprised when passed by with no further guidance considering how popular crypto trading became. If you find any amazing spreadsheets that make this stuff easier please let me know! Find your trading pair on right-hand side of the exchange 2. Gox would occur, but no one took it seriously enough to really devote concrete government resources to addressing it at large. Read the tips section on how to make a successful verification.

The Tax Rules for Crypto in the U.S. Simplified

If you overpaid, make sure to read up on: After you login, click on the Settings button. You can carry forward your losses, so if you have capital gains the next year you can offset. Then if you lose money on a capital investment in the tax year you can write that loss off against that gain. Just slightly confused on this. If you like

What Is My Bitcoin Wallet Address 1 Litecoin In Gbp type of content, feel free to follow our blog posts and sign up for our weekly Lunafi Crypto Newsletter on our website! You will need to enable Two-Factor Authentication to withdraw the money. The government saw that a lot of the ICOs being released mimicked IPOs in nature and deemed that the players in the market were essentially issuing unregulated securities, which is a huge no-no for both of these agencies. In the above example, I am clear about step 1, 2 and 3. After your payment method has been set up, you can make a deposit. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term. You can however cancel your order at any time. Click Here to Get Started. Go to your email address and find an email that looks similar to. How capital gains and losses work? Like-kind property exchange might present a work around forbut

How Do I Sell My Bitcoins For Usd Ethereum Dapp List forward that has been taken off the table… of course, things could change, but that is where we stand right. In general, one would want to find dollar values on the exchange they used to obtain crypto.

These 3 markets are represented by the common base currencies used to buy the wide variety of altcoins available. While this is not required, it's highly recommended. It will generate an address that looks like this:. As a general rule of thumb in terms of receiving cryptocurrency as a business or as a miner, one must account for the dollar value of the coin at the time they received it and then again at the time they trade out of it or use it. Here you can complete your account by adding a payment method. The government saw that a lot of the ICOs being released mimicked IPOs in nature and deemed that the players in the market were essentially issuing unregulated securities, which is a huge no-no for both of these agencies. Again, be careful with your adjustment. Would this be reported in the next years tax return or this years ? In this case we will use Bitcoin Step 2: I will worry about when need be. Please do your own due diligence before making any investment decisions. Good luck; most exchanges keep track of your trades, but not their value in USD at the time of the trade which is information you need. We use cookies to give you the best experience. You would want to ask them directly, but you have it right. Seek guidance from a professional before making rash moves. Thanks for spotting that. So in general you should report any capital gains or losses you had in a year. The next step is to send it to another exchange so you can purchase other cryptocurrencies. It would seem I did not make a profit for Purchasing another cryptocurrency with Bitcoin or Ethereum Note: In this case you would owe taxes on last years profits, but be out of money this year. On the right hand side you will see Markets that are available. IO will send you a sign up email. You will now wait until at least 2 confirmations are complete. All that said, if the end result is that you owe a bunch of taxes, because you made a bunch of profits, stop what you are doing and call a CPA.

An As Simple As it Gets Breakdown of Cryptocurrency and Taxes

A wallet-to-wallet transfer where for example Bitcoin is sent from one Bitcoin wallet to another is not a taxable event, but you do have to account for it. From the information that the SEC provides, the process appears to be relatively straightforward, and it appears that they review applicants and accept them on a regular basis as well. This email address is already subscribed to our newsletter. However, neither of those moves is necessarily the best move for a given person. There is lots of information out there and it is hard to know who to trust and what information is relevant. Why Do You Need Wallets? Thus, it is likely that they will not be too draconian in the measures that they try to implement. Seek guidance from a professional before making rash moves. With these words, Bittrex has suggested two things. Adults would therefore be free to make their own choices, and to mitigate their own risks in whichever way they choose. Buying cryptocurrency with USD is not a taxable event. You will then want to click on Send. This is why margin trading is so risky… it magnifies this whole deal. The recipient of the gift inherits the cost basis. Click the trading pair to be brought to that page of the exchange. Lowest fees for credit card purchases of exchanges we've reviewed. Instead study TA and figure out bots. Here are a few of those challenges that they must overcome. If you did your trading in one year, but then sat on the loss into the next year… yep, that is another thing that can burn traders. Exchanges work like a bank; it is a third-party service provider that you trust to keep your coins safe. If you overpaid, make sure to read up on: Offers Bitcoin and Ethereum trading pairs. If you scroll down, you will see this:. Business reporting can be complex, so consider seeing a tax professional on that one. You can learn more about this exchange in our CEX. At least those who made killer profits in and then bought at the top in are still sitting on coins that could rise in value. Thanks for taking the time to answer all my questions, really appreciate it.

The next step is to send it to another exchange so you can purchase other cryptocurrencies. Every time you trade in and out of Ether and Ripple you have to tally gains and losses at that point. For now, the cryptoworld should stay tuned for further updates and be prepared to adjust accordingly! They also imply that cryptocurrency exchanges managed by experts in digital currencies are less qualified at determining the validity of the coins and tokens sold than the government workers who wish to control such systems. Bittrex, however, has published an official response that clearly outlines the legal status of assets traded on the platform. Sure, they would come up on the radar from time to time when massive events i. Your purchased cryptocurrency will now be available in your wallet. On Cryptocurrency Mining and Taxes: This is why margin trading is so risky… it magnifies this whole deal. So, when in doubt, the cost basis is zero and the rest is profit with forks. Thus, the crypto market was seen as small fish. After you click Register, you will see a page to verify your account similar to the one. On Cryptocurrency and Business:

Bitcoin Vs Forex Trading Gtx 1080 Max Memory Clock Ethereum sure to see the official guidance below and contact a tax professional if you did any substantial amount of trading in — If you scroll down, you will see this:. IO will send you a sign up email. Large Gains, Lump Sum Distributions. Essentially, a security is a tradable financial asset. If you have to file quarterly, then you need to use your best estimates. Did you like this article? Click the trading pair to be brought to that page of the exchange. Section wash sale rules only mention securities, not intangible property. Unfortunately this is all so complex that anyone who

Sec Definition Of Cryptocurrency How To Buy Bitcoin With Ethereum On Bittrex any significant amount of trading really needs to see a tax professional. This is a compilation and summary of our research

What Is Label When Withdrawing On Binance How To Buy Crypto Currency Easily cryptocurrency and taxes. With force, the SEC has no competition. Author Sam Town Samuel is a freelance journalist, digital nomad, and crypto enthusiast based out of Bangkok, Thailand. And who exactly gets

Mining What Are Smart Contracts Profitable Mining Using Ubuntu Nvidia Miningpool, the receiver or the sender? Trying to hide your assets is tax evasion, a federal offensive. Today Omnitude A revolution in eCommerce Ends: How to Trade on Bittrex. What do you think?

Greydon Square Cryptocurrency Civic Coin Crypto

Widely considered the easiest way to buy Bitcoin, Ethereum, Bitcoin Cash, and Litecoin with its incredibly intuitive interface and user experience. Periodic account statements may be relied on to determine the maximum value of the account, provided that the statements fairly reflect the maximum account value during the calendar year. This How To Use A Raspberry Pi For Bitcoin Mining Does The Dark Web Use Ethereum a compilation and summary of our research on cryptocurrency and taxes. However, the US does not have a free market economy, and as such, businesses are forced to comply with regulatory frameworks that arguably do more harm than good. In other words, the SEC wants you to only use government-approved trading platforms. There are a number of crypto tax software solutions to be found online. If you find any amazing spreadsheets that make this stuff easier please let me know! As an avid observer of the rapidly evolving blockchain ecosystem he specializes in the FinTech sector, and when not writing explores the technological landscape of Southeast Asia. Good luck in the future with your trades and thanks. There are way more considerations than there is time, next year make sure you are Sec Definition Of Cryptocurrency How To Buy Bitcoin With Ethereum On Bittrex well in advance. There are a few inherent challenges that the SEC will face on its mission to regulate cryptocurrencies. When you run a business, you pay quarterly taxes. That said, not every rule that applies to stocks or real estate applies to crypto. You pay the rate of each Nvidia Geforce 940mx For Bitcoin Mining Legit Litecoin Faucet you qualify for, on dollars in that bracket, for each tax type. Thanks for reaching out to us. It is not treated as a currency; it is treated like real estate or gold. Thus, the trade of cryptocurrencies falls neatly under the jurisdiction of the Securities Exchange Commission. Registration is simple, only requiring an email address and to create a password. The Unhashed Team is dedicated to teaching the world how to safely get involved in cryptocurrency. I got paid a very small portion of the bitcoin back to my coinbase wallet. Mar 1 — I sold the 50 Sec Decision On Cryptocurrency Cnbc Metal Crypto Currency. Profits are not the same as the gross dollar amount traded, profits are calculated from all capital gains and losses in a year. Long-term gains can be realized at any point in any tax year via the above methods by selling, trading, or using cryptocurrency. If you pay taxes on gains, even if you dont cash out, Litecoin Canada Lts Cryptocurrency you get taxed again also at cashing out? You will see a confirmation page that looks something like this and you need to click Confirm:. Hi Thomas, Thanks for taking the time to answer Solar Cryptocurrency China Crypto Ban my questions, really appreciate it. This process can be Bitcoin Sweep Address Litecoin Alert Twitter bit of a pain, as it requires you to enter a variety of personal details and upload identification documents. These pictures require to take a picture and save it to your computer, but there have been reports of allowing you to use your webcam instead. Thanks for the response. I heard about CoinTracking. So in general you should report any capital gains or losses you had in a year. Regardless of how much you trade you just want to make sure you are keeping a ledger. In a free market, where people voluntarily exchange goods and services, the SEC would be a private organization rather than a government entity. Your order should automatically be executed. Does it Spell Chaos or Innovation? Paste the Bittrex BTC address you copied over into the destination address:. What to do with trades before IRS guidance?

Widely considered the easiest way to buy Bitcoin, Ethereum, Bitcoin Cash, and Litecoin with its incredibly intuitive interface and user experience. Periodic account statements may be relied on to determine the maximum value of the account, provided that the statements fairly reflect the maximum account value during the calendar year. This How To Use A Raspberry Pi For Bitcoin Mining Does The Dark Web Use Ethereum a compilation and summary of our research on cryptocurrency and taxes. However, the US does not have a free market economy, and as such, businesses are forced to comply with regulatory frameworks that arguably do more harm than good. In other words, the SEC wants you to only use government-approved trading platforms. There are a number of crypto tax software solutions to be found online. If you find any amazing spreadsheets that make this stuff easier please let me know! As an avid observer of the rapidly evolving blockchain ecosystem he specializes in the FinTech sector, and when not writing explores the technological landscape of Southeast Asia. Good luck in the future with your trades and thanks. There are way more considerations than there is time, next year make sure you are Sec Definition Of Cryptocurrency How To Buy Bitcoin With Ethereum On Bittrex well in advance. There are a few inherent challenges that the SEC will face on its mission to regulate cryptocurrencies. When you run a business, you pay quarterly taxes. That said, not every rule that applies to stocks or real estate applies to crypto. You pay the rate of each Nvidia Geforce 940mx For Bitcoin Mining Legit Litecoin Faucet you qualify for, on dollars in that bracket, for each tax type. Thanks for reaching out to us. It is not treated as a currency; it is treated like real estate or gold. Thus, the trade of cryptocurrencies falls neatly under the jurisdiction of the Securities Exchange Commission. Registration is simple, only requiring an email address and to create a password. The Unhashed Team is dedicated to teaching the world how to safely get involved in cryptocurrency. I got paid a very small portion of the bitcoin back to my coinbase wallet. Mar 1 — I sold the 50 Sec Decision On Cryptocurrency Cnbc Metal Crypto Currency. Profits are not the same as the gross dollar amount traded, profits are calculated from all capital gains and losses in a year. Long-term gains can be realized at any point in any tax year via the above methods by selling, trading, or using cryptocurrency. If you pay taxes on gains, even if you dont cash out, Litecoin Canada Lts Cryptocurrency you get taxed again also at cashing out? You will see a confirmation page that looks something like this and you need to click Confirm:. Hi Thomas, Thanks for taking the time to answer Solar Cryptocurrency China Crypto Ban my questions, really appreciate it. This process can be Bitcoin Sweep Address Litecoin Alert Twitter bit of a pain, as it requires you to enter a variety of personal details and upload identification documents. These pictures require to take a picture and save it to your computer, but there have been reports of allowing you to use your webcam instead. Thanks for the response. I heard about CoinTracking. So in general you should report any capital gains or losses you had in a year. Regardless of how much you trade you just want to make sure you are keeping a ledger. In a free market, where people voluntarily exchange goods and services, the SEC would be a private organization rather than a government entity. Your order should automatically be executed. Does it Spell Chaos or Innovation? Paste the Bittrex BTC address you copied over into the destination address:. What to do with trades before IRS guidance?

If you overpaid, make sure to read up on: After you login, click on the Settings button. You can carry forward your losses, so if you have capital gains the next year you can offset. Then if you lose money on a capital investment in the tax year you can write that loss off against that gain. Just slightly confused on this. If you like What Is My Bitcoin Wallet Address 1 Litecoin In Gbp type of content, feel free to follow our blog posts and sign up for our weekly Lunafi Crypto Newsletter on our website! You will need to enable Two-Factor Authentication to withdraw the money. The government saw that a lot of the ICOs being released mimicked IPOs in nature and deemed that the players in the market were essentially issuing unregulated securities, which is a huge no-no for both of these agencies. In the above example, I am clear about step 1, 2 and 3. After your payment method has been set up, you can make a deposit. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term. You can however cancel your order at any time. Click Here to Get Started. Go to your email address and find an email that looks similar to. How capital gains and losses work? Like-kind property exchange might present a work around forbut How Do I Sell My Bitcoins For Usd Ethereum Dapp List forward that has been taken off the table… of course, things could change, but that is where we stand right. In general, one would want to find dollar values on the exchange they used to obtain crypto.

These 3 markets are represented by the common base currencies used to buy the wide variety of altcoins available. While this is not required, it's highly recommended. It will generate an address that looks like this:. As a general rule of thumb in terms of receiving cryptocurrency as a business or as a miner, one must account for the dollar value of the coin at the time they received it and then again at the time they trade out of it or use it. Here you can complete your account by adding a payment method. The government saw that a lot of the ICOs being released mimicked IPOs in nature and deemed that the players in the market were essentially issuing unregulated securities, which is a huge no-no for both of these agencies. Again, be careful with your adjustment. Would this be reported in the next years tax return or this years ? In this case we will use Bitcoin Step 2: I will worry about when need be. Please do your own due diligence before making any investment decisions. Good luck; most exchanges keep track of your trades, but not their value in USD at the time of the trade which is information you need. We use cookies to give you the best experience. You would want to ask them directly, but you have it right. Seek guidance from a professional before making rash moves. Thanks for spotting that. So in general you should report any capital gains or losses you had in a year. The next step is to send it to another exchange so you can purchase other cryptocurrencies. It would seem I did not make a profit for Purchasing another cryptocurrency with Bitcoin or Ethereum Note: In this case you would owe taxes on last years profits, but be out of money this year. On the right hand side you will see Markets that are available. IO will send you a sign up email. You will now wait until at least 2 confirmations are complete. All that said, if the end result is that you owe a bunch of taxes, because you made a bunch of profits, stop what you are doing and call a CPA.

If you overpaid, make sure to read up on: After you login, click on the Settings button. You can carry forward your losses, so if you have capital gains the next year you can offset. Then if you lose money on a capital investment in the tax year you can write that loss off against that gain. Just slightly confused on this. If you like What Is My Bitcoin Wallet Address 1 Litecoin In Gbp type of content, feel free to follow our blog posts and sign up for our weekly Lunafi Crypto Newsletter on our website! You will need to enable Two-Factor Authentication to withdraw the money. The government saw that a lot of the ICOs being released mimicked IPOs in nature and deemed that the players in the market were essentially issuing unregulated securities, which is a huge no-no for both of these agencies. In the above example, I am clear about step 1, 2 and 3. After your payment method has been set up, you can make a deposit. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term. You can however cancel your order at any time. Click Here to Get Started. Go to your email address and find an email that looks similar to. How capital gains and losses work? Like-kind property exchange might present a work around forbut How Do I Sell My Bitcoins For Usd Ethereum Dapp List forward that has been taken off the table… of course, things could change, but that is where we stand right. In general, one would want to find dollar values on the exchange they used to obtain crypto.

These 3 markets are represented by the common base currencies used to buy the wide variety of altcoins available. While this is not required, it's highly recommended. It will generate an address that looks like this:. As a general rule of thumb in terms of receiving cryptocurrency as a business or as a miner, one must account for the dollar value of the coin at the time they received it and then again at the time they trade out of it or use it. Here you can complete your account by adding a payment method. The government saw that a lot of the ICOs being released mimicked IPOs in nature and deemed that the players in the market were essentially issuing unregulated securities, which is a huge no-no for both of these agencies. Again, be careful with your adjustment. Would this be reported in the next years tax return or this years ? In this case we will use Bitcoin Step 2: I will worry about when need be. Please do your own due diligence before making any investment decisions. Good luck; most exchanges keep track of your trades, but not their value in USD at the time of the trade which is information you need. We use cookies to give you the best experience. You would want to ask them directly, but you have it right. Seek guidance from a professional before making rash moves. Thanks for spotting that. So in general you should report any capital gains or losses you had in a year. The next step is to send it to another exchange so you can purchase other cryptocurrencies. It would seem I did not make a profit for Purchasing another cryptocurrency with Bitcoin or Ethereum Note: In this case you would owe taxes on last years profits, but be out of money this year. On the right hand side you will see Markets that are available. IO will send you a sign up email. You will now wait until at least 2 confirmations are complete. All that said, if the end result is that you owe a bunch of taxes, because you made a bunch of profits, stop what you are doing and call a CPA.